This article is an on-site version of our Inside Politics newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday.

Good morning. Rishi Sunak’s appointment of Suella Braverman continues to invite difficult questions, the polls continue to be bad, and the new prime minister faces a series of difficult political and economic choices about how to address the UK’s overlapping crises. Some more thoughts on all that in today’s note.

Inside Politics is edited by Georgina Quach. Follow Stephen on Twitter @stephenkb and please send gossip, thoughts and feedback to insidepolitics@ft.com.

‘Leaky Sue’ is done talking to you

One of the reasons behind Rishi Sunak’s ascent to Number 10 was the fact that, after 44 days of Liz Truss, MPs on the left of the party decided to enthusiastically throw their support behind him, rather than worry about the rather large gap between their politics and that of Sunak’s.

Another reason is that Kemi Badenoch, the de facto leader of the party’s thinking right, opted to throw her weight behind Sunak with a bracingly honest assessment of his strengths and Boris Johnson’s limitations in The Times. Most of her former public supporters flowed behind him as a result. (See charts, as the great Martin Wolf says.) Another fine one here by our data editor Martin Stabe:

The third reason is that, while Suella Braverman wasn’t able to bring most of her people along with her, she did enough to drain any momentum away from Johnson’s leadership bid.

Note, though, what is still Sunak’s biggest danger: the large group of Johnson-supporting MPs on the right of the party who in the end, refused to publicly declare support for him.

For Sunak, that is reason enough to take the cost of bringing Braverman — who was forced to quit last week over allegations she had shared confidential information via her personal mobile — back to the cabinet on the chin. But it has come with a significant fallout that has overshadowed yesterday’s slew of government appointments, as Seb Payne highlights. Former Tory party chair Sir Jake Berry accused her of “multiple breaches” of the ministerial code and claimed she was nicknamed “Leaky Sue”. And, according to claims in Harry Cole and James Heale’s forthcoming book on the rise and fall of Liz Truss, Out of the Blue, Braverman leaked market-sensitive information during her first stint as home secretary.

Labour scents blood, too: Sir Keir Starmer has made it clear to frontbenchers that they should keep talking about the “grubby deal” between Sunak and Braverman. Wes Streeting, the shadow health secretary, has claimed that the difference between Starmer and Sunak is that under Starmer, Labour’s “cranks” have been expelled or left, while under Sunak they have a seat at the cabinet table.

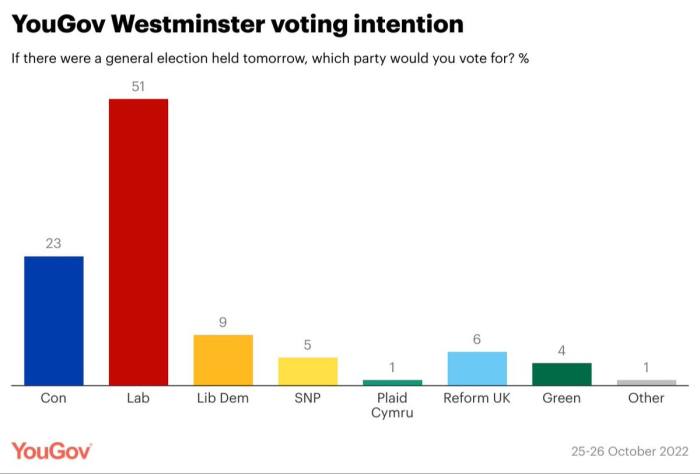

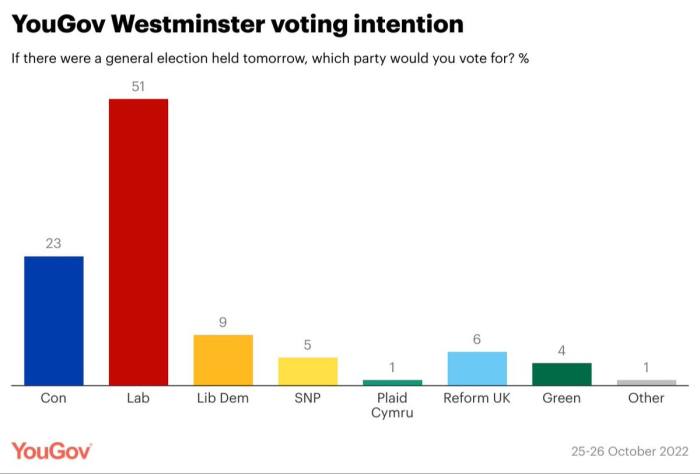

The good news for Sunak is that the first clutch of polls after his installation as prime minister are out, and they show that he is more popular than his party, with his ratings not far behind Starmer. The bad news is that, while he has overseen a statistically significant increase in his party’s poll ratings, they still look like this, in the latest from YouGov:

Given that on November 17, the government will put forward its debt management plan, I find it hard to convince myself that Sunak will be in a better place politically by the end of next month than he is now, as October draws to an unseasonably warm close. In his superb Free Lunch email (requires premium subscription), Martin Sandbu lists a series of options the government could take to avoid making painful spending cuts: a looser debt target, a series of genuinely pro-growth measures, and then what he dubs “the Nike approach to deficits”:

Just pay it. In other words, just raise taxes rather than cut spending further. If £35bn is what it takes to put debt-to-GDP on a downward path, that’s just over 1.5 per cent of GDP. Settling for a stable rather than falling debt ratio would require less, perhaps 1 per cent. Raising tax revenue by that much would simply lift the UK to the OECD average, leaving it still well below almost all other European countries. Politically difficult, perhaps, but economically completely do-able.

“Just pay it” was the approach that got Sunak into so much political trouble last autumn: his Budget, in which he opted to raise taxes and increase public spending, was part of why his first leadership bid unravelled.

Now, Sunak and his chancellor, Jeremy Hunt, are making blood-curdling noises to Tory MPs about the extreme scale of the hole in the public finances (Chris Giles and George Parker have you covered for all of that). One reason for that is they want to soften the blow when they opt to fill in at least some of the hole via tax rises, not spending cuts. But it’s far from clear whether Sunak’s irreconcilable opponents are ready to accept any sort of budget at all from our new prime minister. That the Conservatives’ new leader can’t yet point to a transformation in the party’s fortunes may make it harder still to persuade his fractious party to back difficult measures in his budget.

Shameless self-promotion

I reviewed Emergency State, Adam Wagner’s excellent and important book about the legal underpinnings of the UK’s lockdown and the terrible human rights hangover it has left behind.

Now try this

One of my favourite films of 2022, the excellent Hit the Road, is available to watch at home via Curzon Home Cinema, on Apple TV and on physical release. It tells the story of an Iranian family on a road trip and is told through the perspective of their son. I cannot recommend it highly enough.

However you spend it, have a wonderful weekend (why not start it off with our FirstFT news quiz?)

Top stories today

Recommended newsletters for you

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Credit: Source link