Chinese tourist spending during one of the country’s most important national holidays has exceeded pre-pandemic levels for the first time, authorities said, in a sign of economic momentum after China ended its coronavirus containment policies.

Travel during this week’s labour day holiday was closely watched as an indicator of the Chinese economy’s recovery and as a barometer for consumer spending, which policymakers hope will help boost growth amid a bleak outlook for exports and after a disappointing year of pandemic restrictions damping activity at home.

China recorded 274mn domestic trips over the five days to Wednesday, according to the Ministry of Culture and Tourism, 71 per cent higher year on year and 19 per cent higher than in 2019.

Total tourism revenues were Rmb148bn ($21.5bn), up sharply year on year and 1 per cent higher than the comparable 2019 level, marking the first time that holiday tourism revenues exceeded those before the pandemic.

The figures indicated a clear improvement in travel and spending compared with recent holidays such as lunar new year in January, which was affected by a wave of infections in the country’s biggest cities as the government rolled back its zero-Covid regime.

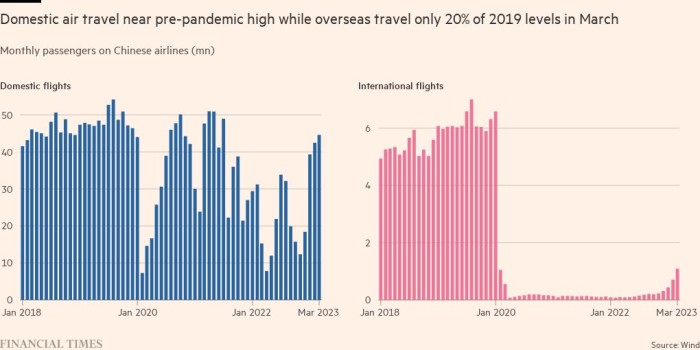

The per capita spending rate nonetheless remained 10 per cent below pre-pandemic levels, with analysts at Citi pointing to “ticket price cut[s] by major attractions and weakened spending power post-Covid”. Outbound travel was also far below 2019 numbers, as visa backlogs and limited international fight ability curbed Chinese tourists’ ability to go abroad.

“The data itself is positive for sure,” said Ting Lu, chief China economist at Nomura, who suggested growth of “in-person services” had driven the country’s recovery this year. But he added that “if other parts of the economy are not doing well, this kind of pent-up demand may not be sustainable”.

The broader economy has shown mixed signals in the early months of 2023 following Beijing’s dramatic U-turn on its Covid-19 strategy, which had weighed heavily on consumer spending by imposing lockdowns and mandating mass testing and travel restrictions for three years.

Gross domestic product added 4.5 per cent year on year in the first quarter, with retail sales increasing 11 per cent in March. But recent measures of factory activity have shown continued sluggishness as the government grapples with a lingering property cash crunch and pressure on exports from high global inflation.

Data released by Chinese business outlet Caixin on Thursday showed the manufacturing sector contracted month on month in April, echoing an official survey on Sunday that prompted warnings from policymakers about the economy’s incomplete recovery.

The commerce ministry pointed to double-digit increases in purchases of gold and silver jewellery, cosmetics, clothing, tobacco and wine over the May holiday, adding that sales of “key catering companies” were up 58 per cent.

Alipay, one of the country’s two dominant digital payment platforms, said there had been a surge in searches for travel industry jobs in mid-April compared with a month earlier.

China’s policymakers have set a cautious 5 per cent growth target for 2023, the lowest in decades, after the economy expanded just 3 per cent last year, failing to reach a 5.5 per cent goal.

But many experts expect this year’s target to be surpassed, and economists at Goldman Sachs said the labour day holiday data “adds conviction” to their forecast for 6 per cent growth.

While domestic travel boomed in early May, outbound travel remains far below pre-pandemic levels, as authorities have only recently restarted issuing travel visas and passports after several years of suspension under the Covid restrictions.

International travellers have also yet to return to China in their previous numbers. Lu at Nomura noted that cross-border flights were at just 38 per cent of the pre-pandemic level over the May holiday.

Credit: Source link